Are Americans drinking less beer? Recent studies suggest that the answer is yes. In 2023, the craft beer industry experienced a decline in sales, marking the first time the industry saw a decline outside of 2020. This trend is supported by a Gallup poll which found that beer is becoming less dominant as a drink choice among Americans, with liquor gaining popularity. Additionally, young adults in the U.S. are progressively becoming less likely to consume alcohol, with a 10% decrease in drinking rates among those aged 18-34 in the past two decades. These findings indicate a shift in drinking preferences and a decline in alcohol consumption, particularly among younger adults, suggesting that Americans may indeed be drinking less beer.

| Characteristics | Values |

|---|---|

| Beer consumption in the US | Beer is the most frequently consumed alcoholic drink in the US, with 37% of respondents in a Gallup poll saying they drink it "most often". |

| Comparison to other drinks | Beer is followed by liquor (31%) and wine (29%) in terms of consumption. |

| Change in consumption over time | Beer is "less dominant" as a drink choice than it was in the early 2000s, while liquor has gained popularity. |

| Craft beer sales | Craft beer sales declined by 2% in the first half of 2023, according to the Brewers Association. |

| Reasons for decline in craft beer sales | People are drinking other types of alcohol, opting for a healthier lifestyle, cutting back on calories, drinking more non-alcoholic beverages, and economic factors. |

| Young adults' drinking habits | 62% of adults under 35 say they drink, down from 72% two decades ago. Young adults are also drinking less frequently and are less likely to drink to excess. |

| Older adults' drinking habits | Drinking has increased among adults aged 55 and older, with a 10-point increase in drinkers in this age group since 2001-2003. |

What You'll Learn

Young adults are drinking less

Young adults in the US are drinking less than they used to. According to Gallup, 62% of adults under 35 say they drink alcohol, a decrease from 72% two decades ago. This shift is even more pronounced when considering drinking frequency and excessive drinking. The percentage of young adults who drank in the past week has dropped from 67% in 2001-2003 to 61% in 2021-2023, indicating a decline in regular drinking among this age group. Moreover, the rate of overdrinking among 18- to 34-year-olds has decreased from 21% in 2001-2003 to 13% in 2021-2023.

Several factors could contribute to this trend. One reason could be the changing demographic makeup of young adults in the US. The percentage of young adults from racial and ethnic minority groups has nearly doubled in the past two decades, and non-White Americans are generally less likely to consume alcohol. Health concerns could also play a role, as young adults are increasingly concerned about the health risks associated with alcohol consumption. The percentage of 18- to 34-year-olds who believe that moderate drinking is unhealthy has risen from 34% to 52% in the last five years.

Another factor could be the growing popularity of marijuana among young adults. Marijuana use has almost doubled among this age group since 2013, and it may be replacing alcohol as a preferred substance. Additionally, the craft beer industry's recent struggles could also be a factor. Craft beer sales declined by 2% in the first half of 2023, and while there are multiple complex reasons for this, one key factor is the rise in popularity of other types of alcoholic beverages, such as spirits and liquor.

The decrease in drinking among young adults is particularly notable when compared to older age groups. Drinking has increased among adults aged 55 and older, and middle-aged adults remain the leading alcohol consumers. This shift in drinking habits across age groups could have significant implications for the alcohol industry, particularly the beer industry, which has traditionally relied on younger drinkers as their core customer base.

Beer Distribution in Georgia: A Complex System Explained

You may want to see also

Health concerns

While there are a multitude of reasons for the decline in beer consumption in the US, health concerns are a significant factor.

The health risks associated with alcohol consumption are well-documented. Excessive alcohol intake can lead to various adverse effects on the body, including liver damage, cardiovascular problems, weakened immune system, and increased risk of certain cancers. Additionally, alcohol is often associated with high calorie and sugar content, which can contribute to weight gain and other health issues. As a result, individuals who are conscious about their health may choose to reduce their beer consumption or opt for lower-calorie or non-alcoholic alternatives.

Moreover, the COVID-19 pandemic may have also played a role in increasing health consciousness among Americans. During the pandemic, there was a greater focus on maintaining overall health and boosting immunity. This may have influenced individuals to reevaluate their drinking habits and make healthier choices, including reducing their beer intake or abstaining from alcohol altogether.

The decline in beer consumption due to health concerns is not limited to young adults. Gallup's findings indicate that there has been a 13-point increase in middle-aged adults who believe that moderate drinking is unhealthy, although this change is less pronounced compared to the younger demographic. Nevertheless, it demonstrates a growing trend across different age groups in recognizing the potential health risks associated with alcohol consumption.

In addition to health concerns, other factors contributing to the decline in beer consumption include shifting preferences towards other types of alcoholic beverages, economic considerations, and lifestyle choices that prioritize healthier alternatives.

Beer Blackout: Understanding Alcohol's Impact on the Body

You may want to see also

Marijuana use

While it is difficult to establish a direct causal relationship between marijuana use and the decline in beer consumption in the United States, it is worth examining the trends and potential connections between these two substances. Marijuana is one of the most commonly used substances in the country, with 17% of Americans reporting that they smoke marijuana, and it is legal for recreational or medical use in many states.

One factor that may influence the drinking habits of Americans is the increasing acceptance and availability of alternative substances, such as marijuana. As social attitudes and legal frameworks surrounding marijuana evolve, it is possible that some individuals may be substituting beer with marijuana for their desired altered state of consciousness. This substitution could be driven by a variety of factors, including the perception of marijuana as a "safer" or more desirable option compared to alcohol.

Research suggests that the effects of combining alcohol and marijuana can be unpredictable and dangerous. Drinking alcohol before smoking marijuana can intensify the effects of THC, the psychoactive ingredient in cannabis, leading to a stronger high. This interaction may be particularly appealing to some individuals, but it can also increase the risk of negative side effects, such as nausea, vomiting, dizziness, and anxiety. The delayed onset of marijuana edibles can further complicate the experience, leading to overconsumption and an extended, more intense high.

Additionally, the simultaneous use of alcohol and marijuana has been associated with an increased risk of adverse outcomes. Studies have found that using both substances together is linked to a higher likelihood of drunk driving, social consequences, self-harm, and unsafe driving behaviors. The combination may also lead to a higher risk of developing a dependence on one or both substances, as well as potential long-term negative effects on cognitive function and brain structures.

While the relationship between marijuana use and beer consumption patterns in the United States is complex and influenced by a multitude of factors, it is plausible that the increasing popularity and availability of marijuana could be contributing to a shift in drinking habits, particularly among certain demographics. Further research and data are needed to establish a definitive link and understand the full scope of this potential connection.

Understanding Beer Columns: Brewing Process Simplified

You may want to see also

Drinking trends

Americans are drinking less beer, with the craft beer industry experiencing a decline in sales. This shift in drinking preferences is attributed to various factors, including lingering pandemic disruptions, unsustainable growth rates, inflation, and lifestyle trends embracing healthier choices. According to a survey by the Brewers Association, the primary reason for reduced craft beer consumption is the rise of other beverage alcohol options.

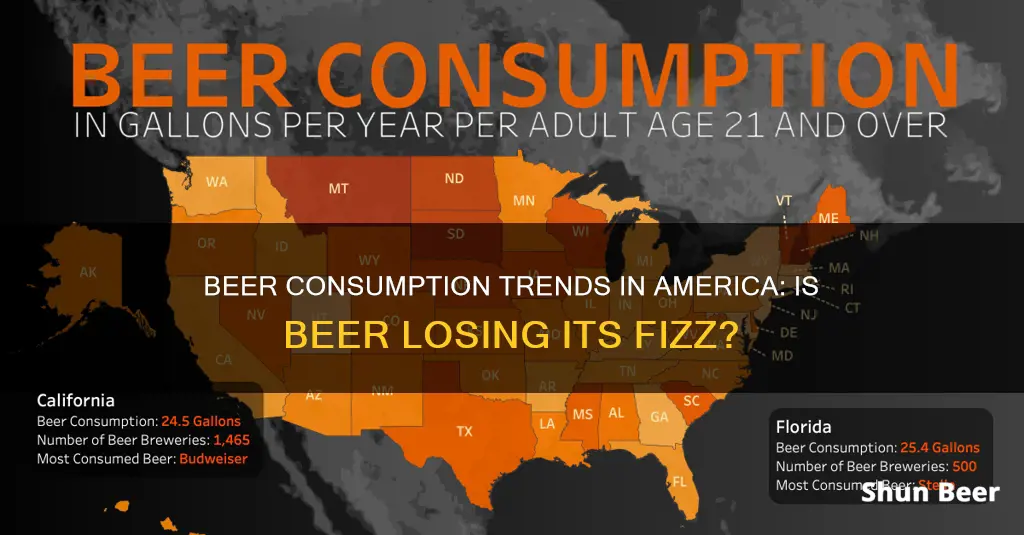

The drinking trends in the United States are evolving, with beer losing its dominant position. While beer remains the most frequently consumed alcoholic beverage, its popularity has decreased since the early 2000s. A Gallup poll from 2023 revealed that 37% of respondents chose beer as their preferred drink, followed by liquor at 31% and wine at 29%. However, liquor has gained popularity, with 31% of drinkers naming it as their favourite, the highest percentage recorded by Gallup.

Young adults in the U.S., particularly those under 35, are driving the decline in beer consumption. In 2023, 62% of young adults reported drinking alcohol, a decrease from 72% two decades ago. This trend is influenced by demographic changes, with a more diverse range of racial and ethnic backgrounds among young adults, as non-White Americans tend to drink alcohol less frequently. Additionally, health concerns about the risks of alcohol consumption have grown, especially among younger generations.

In contrast to young adults, drinking has increased among older adults aged 55 and above. This shift is attributed to generational change, with Baby Boomers, born between 1946 and 1964, consistently being more likely to consume alcohol than the Silent Generation (born before 1946). As the Baby Boomers age, they contribute to the rising drinking rates among older adults.

Overall, the drinking landscape in the U.S. is witnessing a shift away from beer, particularly craft beer, towards other types of alcoholic beverages. This trend is influenced by various factors, including changing demographics, health concerns, and competing beverage options. While beer remains the most popular drink, its dominance is being challenged by liquor and, to a lesser extent, wine.

Drinking Beer and Driving: A Dangerous Mix

You may want to see also

Craft beer sales decline

The craft beer industry has experienced unprecedented growth over the past decade. However, recent reports indicate that this trend may be changing, with sales declining by 2% in the first half of 2023, according to the Brewers Association. This is the first decline observed since 2020, when the COVID-19 pandemic significantly impacted the industry.

The reasons for this decline are multifaceted and complex. One significant factor is the shift in consumer preferences towards other types of alcoholic beverages, such as spirits and wine. This trend is particularly evident among women, who are opting for wine more frequently than men. Additionally, health-conscious consumers are increasingly mindful of their calorie intake and are opting for non-alcoholic beverages or healthier alternatives. The pandemic, intense growth rate in recent years, general inflation, and lifestyle trends have also contributed to the decline.

The impact of the pandemic on the craft beer industry is evident when examining the data. In the first 2.5 months of 2020, before COVID-19 hit, craft beer volume growth was on its usual 3% to 4% trajectory. However, by the end of June 2020, craft beer volumes had declined by around 10%, according to a Brewers Association survey. This decline can be attributed to the closure of breweries, bars, and restaurants, as well as a decrease in social gatherings and events where beer is typically consumed.

While the craft beer industry faced challenges during the pandemic, it is important to note that the number of craft breweries has continued to grow. As of June 30, 2020, there were 8,217 active craft breweries in operation in the United States, up from 7,480 at the halfway point of 2019. This indicates that despite the decline in sales, the industry remains resilient and dynamic.

The decline in craft beer sales has also been influenced by the broader shift in consumer preferences away from beer as a dominant drink choice. A Gallup poll from 2023 found that while beer was still the most frequently consumed alcoholic beverage, with 37% of respondents choosing it as their drink of choice, liquor (31%) and wine (29%) were not far behind. This shift towards spirits and wine, particularly among women and older age groups, presents a challenge to the craft beer industry, which needs to adapt to changing consumer preferences and capture demand from other segments of the alcoholic beverage market.

To counter this decline, industry experts suggest focusing on draft beer, as it offers a unique and authentic experience for consumers. However, this strategy may be challenging as distributors have reportedly deemphasized draft beer in favor of other alcoholic beverages.

Wheat-Free, Beer-Friendly: Enjoying Beer Without Wheat

You may want to see also

Frequently asked questions

Yes, according to a 2023 Gallup poll, beer is "less dominant" as a drink choice than it was in the early 2000s.

There are several reasons for the decline in beer consumption among Americans. One reason is the growing popularity of other types of alcohol, such as liquor and wine. Other factors include health concerns, a decrease in overall drinking, and a shift towards healthier lifestyles.

Yes, there are demographic differences in beer consumption. Men are more likely to drink beer than women, and younger adults (aged 18-34) are more likely to opt for beer and liquor, while older adults prefer wine. Additionally, the percentage of drinkers has decreased among younger adults and increased among older adults over the past two decades.